(Note: This content is a 6-min read)

A business can look for funding in multiple ways. The most used method would be to apply for a loan from a bank. However, there are other ways a company can obtain funds. One of them is crowdfunding [www.ata-plus.com], which is the practice of funding by raising an l amount of money from a large number of people and is typically done using the internet. This new form of capital formation emerged following the 2008 financial crisis as early-stage enterprises faced great difficulties in generating funds.

There are four different types of crowdfunding:

Crowdfunding around the world

Since then, crowdfunding has spread across the developed nations and is now slowly growing in developing countries. The highest total transaction values were mainly distributed between Asia, North America and Europe. In 2020, China leads the way in terms of the crowdfunding transaction value with a total of USD 7.08 billion, followed by the US (USD 0.78 billion), the UK (USD 0.1 billion) and France (USD 0.09 billion).

In China, P2P lending platforms were touted as a model to reshape the nation’s financial landscape. It tapped into the opportunity in the Chinese market where banks usually do not lend to consumers and small businesses without an established credit score system. More than 10,000 P2P online platforms sprang up in China.

However, there was a turnaround in late 2017 when China’s leadership noticed the growing risk with these platforms and vowed to squeeze them out of the financial system. Authorities indicated that the high risk in the high return products that were offered by P2P platforms and warned that many could potentially be illegal funds or Ponzi schemes, which use the new income to pay off older investors. Most of the firms were forced to close due to tighter policies. On top of that, authorities have also banned new online lending platforms from entering the market.

Crowdfunding in Malaysia

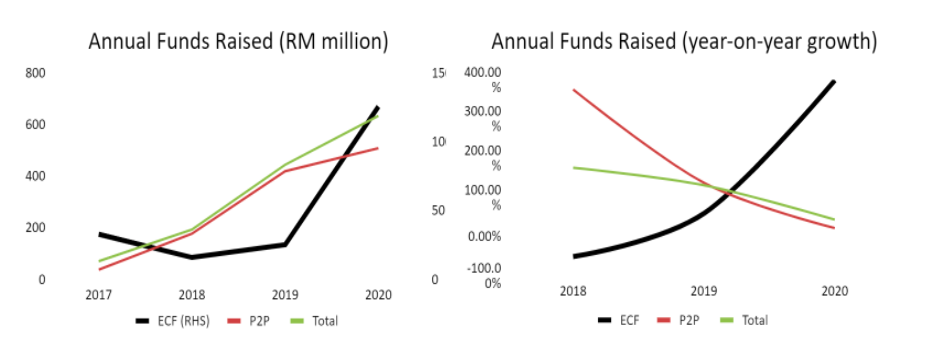

Source: Securities Commission Malaysia

In Malaysia, crowdfunding activities have continued to increase since Securities Commission Malaysia started its data documentation back in 2017, which indicates rising awareness of these alternative fundings in Malaysia. During the first year, the funds raised was nearly RM 70 million with ECF contributing 47% while P2P contributing the other 53%. There was a significant increase in 2018 mainly contributed by P2P crowdfunding raising close to RM180 million (2017: RM37 million), growing 375% year-on-year, while ECF reported negative growth in the same period.

Nonetheless, funds raised from ECF increased exponentially in the following two years, recording a growth of 59% year-on-year in 2019 and 399% year-on-year in 2020. This could be due to the loss of income from many entrepreneurs following the COVID-19 outbreak as they look into various ways to raise funds to support their businesses. The MyCIF matching fund from the Government (for every RM4 raised from the crowd, the Government will match RM1, up to RM1 million for every ECF campaign) may have also contributed to this growth. At the same time, funds raised from P2P crowdfunding also continued to grow, despite a slower increase each year (2019: 137% year-on-year; 2020: 21% year-on-year).

Examples of successful crowdfunding campaigns at Ata Plus

The amount of successful campaigns and the number of successful issuers on ECF platforms has also increased dramatically last year. In 2020, there was a 172% increase in successful campaigns compared to the previous year, while the number of successful issuers rose 170%. Since 2017, the total number of successful issuers rose to 183 in 2020. Below are some of the successful campaigns at Ata Plus:

Data as of 6th July 2021

In conclusion, looking at the trends and the SME financing needs, it is highly likely that the crowdfunding market could continue to grow this year, especially in Malaysia, but the pace at which it grows may temporarily be disrupted following the imposition of MCO 3.0 and EMCO to certain states in Malaysia to contain the record rise in Covid-19 infections. However, there could be an increase in demand for crowdfunding when the pandemic tapers off as entrepreneurs seek funds to start a new venture or to finance their current businesses.

Author Profile

- I'm an analyst that is passionate about technology & innovation. Companies such as Google and Apple inspire me with new products that simplify our everyday lives.

Latest entries

PerspectivesDecember 9, 2021Is Real Estate Still a Hot Investment Option?

PerspectivesDecember 9, 2021Is Real Estate Still a Hot Investment Option? AgricultureNovember 22, 2021Gaining “Durian Runtuh” Out of the King of Fruits

AgricultureNovember 22, 2021Gaining “Durian Runtuh” Out of the King of Fruits FoodOctober 8, 2021Healthy Bites, Healthy Life!

FoodOctober 8, 2021Healthy Bites, Healthy Life! CrowdfundingSeptember 27, 2021Infusing Technology to transcend the eyewear industry!

CrowdfundingSeptember 27, 2021Infusing Technology to transcend the eyewear industry!

No Comments