(Note: This content is an 8-min read)

A business has many reasons to start raising funds, which include acquiring assets, boosting production, or even buying another company. It may even be simply to improve the company’s cash flow. Startups will require funds to kick start their entrepreneurship journey or to expand their business. Whatever the reasons, there are various ways to source the necessary finance. This includes getting a loan from a bank or using alternative fundings such as borrowing from many different lenders through Peer-to-Peer platforms or raising funds through Ata Plus in equity crowdfunding. Whichever you choose, there are pros and cons to each of these.

Bank Loans

The most common way to raise funds is by getting a loan from a bank. Almost all high street banks offer business loans, ranging from as low as RM10,000. These borrowings can be applied by all but the maximum funds depend on the size of the business. While bank loans are generally the top-of-mind channel and many would think, as a ‘fast’ way to raise funds, there are a few drawbacks to incurring debt, especially for startups.

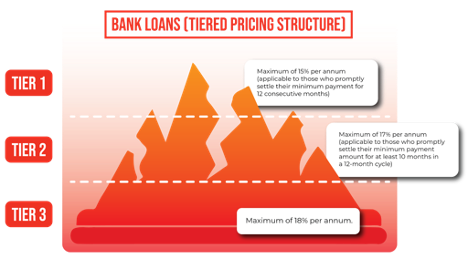

The biggest downside is the need to pay interest rates or profit rates, and other charges. Regardless of how successful the company has become, business owners need to pay the full principal plus interest rate/profit rate. These finance charges will be levied on any of the unpaid outstanding balance including all Finance Charges and any fees (except late payment charges) that were carried forward from the previous statement balances at the prevailing rate (based on a tiered pricing structure your payment history) until the outstanding balances on your credit card statement are settled in full.

Source: Bank Negara Malaysia

Peer-to-Peer Crowdfunding

Besides bank loans, entrepreneurs could also acquire funds by starting a campaign on a Peer-to-Peer (P2P) crowdfunding platform. P2P lending matches up smaller-scale investors with small businesses looking for funds, cutting out the middlemen. Applications can be made online and they can get a loan drawn from cash pooled by savers looking for a better return on their money. In Malaysia, only locally registered sole proprietorships, partnerships, limited liability partnerships, private limited and unlisted public companies, are allowed to be hosted on a P2P platform.

While there is no limit imposed by Malaysia’s Securities Commission on the amount that can be raised, the rate of financing will depend on the outcome of the issuer’s risk scoring conducted by the P2P operator. After completing all the screening and documentation required, the firm will be able to start crowdfunding activities. A successful campaign depends on the ability of the issuer to achieve at least 80% of the targeted amount in a set amount of time. If the target amount is successfully raised, they are eligible for the special assistance from the government, which is called Malaysia Co-Investment Fund or MyCIF, which provides an additional RM 1 for every RM 4 that is raised. MyCIF’s maximum investment in each P2P campaign is limited to RM1 million. However, if they fail to get at least 80% of the targeted amount, funds will be returned to investors. This can be seen as an advantage to the issuing company as it gives them an indication that their reason to fundraise may not attract many people.

However, there are several disadvantages of being hosted on a P2P platform apart from the penalties on late payments, and interest rates charged on the borrowings. For instance, if the campaign manages to attract many investors and exceeds the target amount, the operator will need to return the money or reject the additional offers. Additionally, the issuer also cannot be hosted on multiple platforms for the same reason. Therefore, it limits the amount of borrowing the firm can make for a particular project. It can be said that this type of funding is not a guaranteed way of acquiring funds when compared to bank loans.

ECF

On the other hand, equity crowdfunding (ECF) offers a different route when compared to both bank loans and P2P financing. Investors who provide financing to the start-up or MSME via ECF will receive equity or shares from the company and will become one of the shareholders of the company. Over time, if the company’s business does well, the investor who is now a shareholder will benefit from either the potential dividend paid out by the company; the sale of the shares to new investors, or if the company becomes eligible to list on the stock exchange. Therefore, the issuing company does not have to bear the cost of the principal + interest rates.

To crowdfund in an ECF platform in Malaysia, only locally incorporated private limited companies (excluding exempt private companies), unlisted public limited companies, limited liability partnerships and a registered microfund managed by a licenced venture capital management company with the Securities Commission are allowed. Besides that, the maximum amount allowed to be raised is capped at RM 20 million which is much higher than what is generally offered on a P2P platform. However, similar to P2P, the firm must achieve the minimum target within a set amount of time to successfully close the campaign and receive the funds. Typically for ECF campaigns, the fundraising duration is 90 days on average. Failure to raise the minimum funding target will result in a refund to the respective investors.

Nonetheless, ECF platforms such as Ata Plus provide assistance to entrepreneurs on the marketing and promotion of their crowdfunding campaigns to attract investors. This includes guidance on campaign strategy and offers editorial services for the business owner’s ECF Campaign deal page. Not only does this benefit issuers in the short term but also in the long run as people become more aware of the brand and products/services of the business. Apart from that, companies can also benefit from MyCIF when they raise funds through ECF. However, in the event where the ECF campaign exceeds 50% of its initial investment target, MyCIF may consider reducing the co-investment percentage.

Family, Friends, Fools

Lastly, an entrepreneur can also raise funds from the 3 F’s, which are friends, family, and fools. Friends and family members who want to support your business venture could lend or gift funds. In some cases, friends or family may want to invest or purchase an ownership interest in the business venture. This is the most basic form of crowdsourcing. The reason fools are grouped into this category relates to the risk associated with lending or investing in a seed venture. Generally, these individuals are not sophisticated investors; rather, they invest foolishly or whimsically.

Financing from these people does not involve the formal review process or due diligence involved in commercial loan or angel investment situations. That is, they are not going to conduct a thorough review of your credit history or require extensive collateral to secure the loan. The close relationship between friends or families is also generally flexible about repayment options and applicable interest rates.

In conclusion, the choice between the three types of funding ultimately depends on what type of business you are running and how much you plan on raising. For a sole proprietor or a small startup company that wants to raise below RM 200k, they could take bank loans or opt for P2P crowdfunding. To avoid interest rates, entrepreneurs could ask family and friends to borrow some money. Meanwhile, a bigger business may want to start an ECF campaign due to the higher maximum amount that they can raise, increase their marketing, and also avoid interest charges.

Author Profile

- I'm an analyst that is passionate about technology & innovation. Companies such as Google and Apple inspire me with new products that simplify our everyday lives.

Latest entries

PerspectivesDecember 9, 2021Is Real Estate Still a Hot Investment Option?

PerspectivesDecember 9, 2021Is Real Estate Still a Hot Investment Option? AgricultureNovember 22, 2021Gaining “Durian Runtuh” Out of the King of Fruits

AgricultureNovember 22, 2021Gaining “Durian Runtuh” Out of the King of Fruits FoodOctober 8, 2021Healthy Bites, Healthy Life!

FoodOctober 8, 2021Healthy Bites, Healthy Life! CrowdfundingSeptember 27, 2021Infusing Technology to transcend the eyewear industry!

CrowdfundingSeptember 27, 2021Infusing Technology to transcend the eyewear industry!

No Comments